Investing

Personal Finance Guide

This is section 3 of the goerFI Personal Finance Guide.

MAIN POINTS

1. What is the stock market? What are stocks, mutual funds and index funds?

The stock market is where investors (including you) connect to buy and sell investments — most commonly, stocks, which are shares of ownership in a public company. When you buy a share of a stock, you are buying a small fractional share of a company. Buy a share of Coca-Cola, and you own 0.0000000002% of Coca-Cola, for example. As that company performs well and makes a profit, the value of each share will go up, and you will have made money. Because the employees and executives of Coca-Cola want to do their jobs well, make a profit, and expand their business, their motivation and hard work are the foundation for our belief that investing in that company’s stock is worthwhile. But Coca-Cola won’t have a record year every year, nor will any company. Investing in individual stocks is an extremely challenging game to win over the long term and requires much effort. Because of this, groups of stocks are often sold together in the form of a mutual fund or index fund. Instead of buying a share in an individual stock or company, you can buy a share of a mutual fund or index fund, which itself is invested in dozens or hundreds of other companies. In doing so, you are not putting all of your eggs into one basket, so it is a less risky investment. Mutual funds and index funds differ primarily in the fact that mutual funds are actively managed by professionals, who charge the investors (you) fees, while index funds are not actively managed and charge very low fees. This is explained further below.

2. The stock market always goes up long-term, but it’s a volatile ride in the short-term. you have to have the guts to stay in for the long-term. If you get cold feet and sell when the market is down, then you will lose money.

When you look at the value of the stock market collectively, you can see that over time, the value relentlessly goes up. There are two main reasons for this: 1) The stock market is made up of real, living companies, each striving to succeed and 2) the stock market is self-cleansing. It is self-cleansing in the fact that the worst any publicly-traded company can do is lose all of its value, go to $0, and cease to exist. Meanwhile, new companies are being started all the time and there is technically no upper limit to their success. They could grow 1000% in a few years, or even more. When you combine the collective outcome of companies being started and unsuccessful companies dying, the outcome is growth. On average, the US stock market has grown about 10% in value per year for the past 100 years.

“Investing in the stock market does come with risks, but with the right investment strategies, it can be done safely with minimal risk of long-term losses. Day trading, which requires rapidly buying and selling stocks based on price swings, is extremely risky. Conversely, investing in the stock market for the long term has proven to be an excellent way to build wealth over time.

For example, the S&P 500 has a historical average annualized total return of about 10% before adjusting for inflation. However, rarely will the market provide that return on a year-to-year basis. Some years the stock market could end down significantly, others up tremendously. These large swings are due to market volatility, or periods when stock prices rise and fall unexpectedly.

If you’re actively buying and selling stocks, there’s a good chance you’ll get it wrong at some point, buying or selling at the wrong time, resulting in a loss. The key to investing safely is to stay invested — through the ups and the downs — in low-cost index funds that track the whole market so that your returns might mirror the historical average.”

What is the Stock Market and How Does It Work? – NerdWallet

3. Our kind of investing is not day trading but “buy and hold investing”.

“Trading” stocks is the practice of quickly buying and selling stocks, hoping to make a small profit on the daily change in stock price. Long-term investors approach it differently: buying a stock, mutual fund, or index fund every month and holding it for 10, 20, 30 years until you need to sell some of your portfolio to live off of in retirement. Our approach to investing is slow-cooker perfection and has nothing to do with the talking heads on TV, or ‘how well the market is doing today’. Buy and hold investing is the primary strategy of most individual investors. The ‘hold’ part is crucial.

“Buy and hold investing” is the primary strategy of most individual investors. The ‘hold’ part is crucial.

There will be market dips, dives, and crashes. In a market crash, it’s terrifying to see your portfolio drop 30% in value in a few weeks or days. But if you hold on, the market will recover. If you sell your investments (the investing equivalent of taking off your seatbelt at the scariest part of a roller coaster), all you’ve done is lock in those losses. If you keep your seatbelt on and don’t sell during a market recession or crash, you have not lost anything. You still own the same amount of shares as before, but they are just temporarily worth less. With long-term investing in mind, you can rest assured the market will bounce back and set new heights before you need to start drawing money from your accounts.

4. ‘Time in the market’ is always better than ‘timing the market’.

The best time to start investing was 10 years ago; the second-best time is today.

Don’t delay investing because you think you want to wait until a good time to invest. The best time to start investing was 10 years ago; the second-best time is today. Your money will grow best not because you picked the perfect days to invest and withdraw the money, but because you have it invested for many years/decades. This principle has proven true time and time again.

A simple strategy for this is ‘dollar-cost averaging‘. It basically means that you set your accounts to invest new money at regular intervals, usually the same frequency as your paychecks. By automating it, you reduce the risk of accidentally buying too much when the market is high. This cures the common question many new investors ask “Should I invest in the market right now? It’s so high/low/<insert excuse>…“

5. Invest in low-cost broad-based index funds.

As explained in the first point, index funds charge very low fees compared to mutual funds. While a mutual fund is a hand-selected grouping of stocks and investments, chosen by investment professionals, an index fund is a computer-generated cross-section or automated section of the entire stock market. For example, the S&P 500 Index tracks the 500 largest companies in the stock market. There is also a Total Stock Market Index, which literally includes every publicly traded stock. It doesn’t take an investment professional to track that index. When there are fewer investment professionals picking stocks, that means fewer fees for the investor. In the end, studies show that low fees are the most important factor for an individual investor’s success.

Many investment companies (Vanguard, Fidelity, Schwab, etc) will have their own index fund that tracks the total stock market. When an investor has an account (brokerage account, 403b, 401k, IRA) with that investment company, the investor would likely do best to use the fund from that institution for tracking the total stock market (use Vanguard’s total stock market index fund if your account is with Vanguard, use Fidelity’s if your account is with Fidelity.)

Vanguard and Fidelity are favorites in the FI community. Vanguard invented index funds and has been a mainstay in the business since the beginning. Fidelity has in recent years gained a strong customer base through their easy-to-use website and ultra low-cost index funds. Guidestone is referenced here as a common 403b institution for goers. The following index funds all track the total stock market and would perform statistically the same, only differing in fees charged to the investor.

| Institution | Total Stock Market Index Funds | Expense Ratio |

|---|---|---|

| Vanguard | VTSAX (Vanguard Total Stock Market Index Admiral Shares) | 0.04% |

| Fidelity | FSKAX (Fidelity Total Market Index Fund) | 0.015% |

| Guidestone | GEQZX (GuideStone Funds Equity Index Fund Investor Class) | 0.4% |

6. Fees matter a lot. A 0.2% difference in fees can be a game-changer. Choose index funds over mutual funds.

A mutual fund is a managed investment, in which teams of investment professionals make decisions on a regular basis of which investments to change within the mutual fund. Just like you might choose to stop investing in a stock that you expect will perform poorly, mutual fund advisors regularly adjust and change the investments within the fund for their best attempt at making a profit. While the advisors of very few mutual funds are able to consistently make good decisions and their mutual fund excels above others and the average growth of the market, most do not. Even the mutual funds that outperform the market for a few years usually don’t do so for decades but only for a season. Not only that, but those mutual fund advisors need to be paid. They receive their salaries from the fees they charge the investors (you). These seemingly innocuous fees are usually less than 1%, but they can add up over time. The percentage charged to you is called the “expense ratio”. You might see expense ratios of 0.5% or 1.2% and think, “that’s hardly anything!”. But be aware! These fees can eat into your savings significantly. Think of a person who has a retirement portfolio of $1 million.

- $1,000,000 invested in a mutual fund with a 1% expense ratio will pay $10,000 in fees annually. (regardless of how that mutual fund performed)

- $1,000,000 invested in VTSAX with 0.04% expense ratio will pay $400 in fees annually.

You can find these fees by searching the name of the mutual fund or index fund on google and adding “expense ratio”. Know the expense ratio for every mutual fund or index fund you are invested in.

Because of the power of compounding interest, the fees charged to you today are not just money lost this year alone, but that money then misses out on compounding interest in future years. You can calculate the impact of fees on your portfolio by using this calculator.

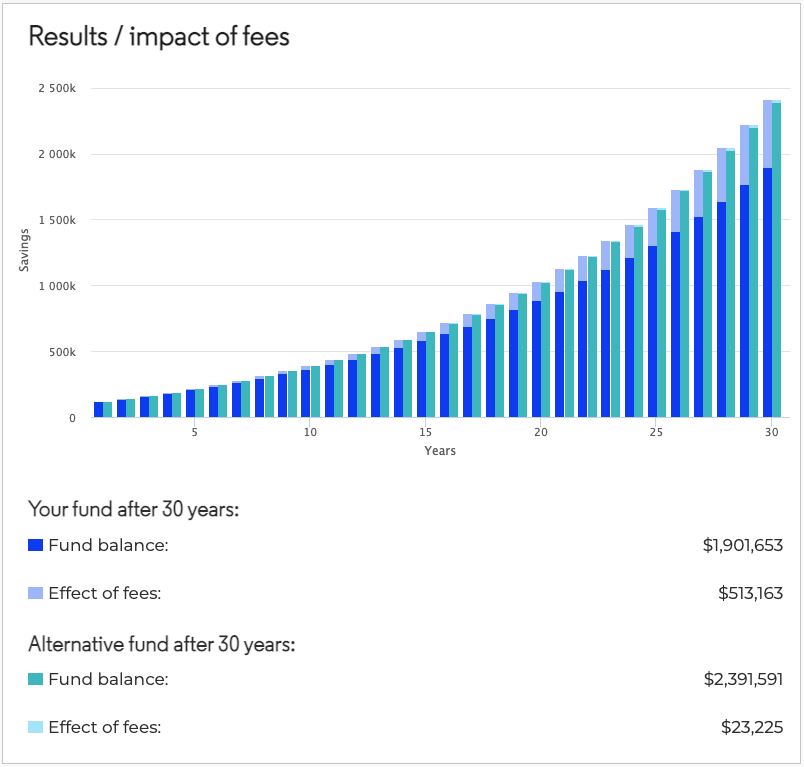

The following graphic shows the impact of fees on 2 accounts compared. The variables included in the calculation were:

| “Your Fund” | “Alternative Fund” | |

| Starting Balance | $100k | $100k |

| Additional Amount Invested Monthly | $1k | $1k |

| Annual Growth | 8% | 8% |

| Expense Ratio | 1% (how bad can it be?) | 0.04% |

The damage of a 1% expense ratio rather than a lower 0.04% expense ratio was $513,163 – $23,225 = $489,938. Nearly a half of a million dollars, lost to fees.

Always seek to eliminate or reduce fees. Don’t just take our word for it: investing all of your retirement in a low-cost index fund is exactly the advice that Warren Buffet gave to his family to manage his fortune.

Learn more about avoiding investment fees here:

7. How do I invest in bonds? What does it mean that my portfolio is conservative or aggressive, and how do I ‘rebalance my portfolio?”

When investing in stocks, it’s also important to know how to invest in bonds. Bonds are basically a loan between a creditor (you) and a lender (a corporate company, state governments, US federal government). They promise to pay you back your loan with interest on a certain date. Loans can act as a shock absorber for the individual investor who is invested in the whole stock market. When the stock market goes on its ruthless climb up, there are plenty of dips and dives along the way. Bonds typically behave opposite to the stock market, so they go up in value when the stock market goes down. Most investors will maintain a ratio of stocks to bonds in their portfolio. A 100% stocks / 0% bonds portfolio is considered aggressive and risky. A 60% stocks / 40 % bonds portfolio is considered very conservative.

For the long-term buy-and-hold (hold on for dear life!) investor, your salary provides you with the money you need until retirement. It does not matter to you if the stock market dives substantially before it inevitably climbs again. But when you reach retirement age, you will most certainly care how the stock market is doing because you will be pulling money from your retirement accounts regularly to fund your lifestyle.

During wage-earning years, most individual investors can invest in between 80-100% stocks / 0-20% bonds. For those willing, 100% stocks have statistically resulted in higher returns in the long term. When approaching retirement, you will want to adjust your portfolio to become more conservative. Then how can you invest in bonds? There is a total bond market index that functions similarly to the total stock market index, allowing you to simplify your investment strategy to 2 funds.

As the value of your investments changes and grows over time, your percentages will shift and need ‘rebalancing’. In a year that the stock market does well, your 90%/10% portfolio might actually now look like 93%/7%. Without realizing it, the stock market gains have actually made your portfolio more aggressive. Many investors choose to do this annually, by selling some of one fund and buying the other. When you have only 2 funds (total stock market index and total bond market index), this is easily done in a few clicks online.

8. Is a Target Retirement Date Fund a good choice for me?

A Target Retirement Date Fund is one where the investor stays invested in the same fund for their entire investing lifetime, and the fund changes its investments automatically to become more conservative as the investor nears retirement age. Usually, these have names like, “MyDestination 2035” or “Target Retirement 2035 Fund”, where the investor intends to retire around the year 2035. While these funds do make investing as simple as possible, they usually will fail the individual investor on 2 points: 1) The fund will become too conservative much earlier than most investors would actually want, which eats into the long-term gains that could be had if the investor was more aggressive. 2) The fund will charge more fees than the low-cost index funds. Following the approach described in this guide will achieve better results with fewer fees than a target retirement date fund.

9. What about cryptocurrencies? Should my investment approach include Bitcoin or something similar?

Investing in cryptocurrencies is fundamentally different from investing in index funds, or individual stocks. As described in the first section, a stock is not just an investment but is representative of the underlying value of the company and the products or services that it produces. When an investment produces something of real value, that’s a solid indicator of how safe of an investment it could be. Cryptocurrencies are a form of currency that aren’t tied to a central bank of any country. They were initially invented to try and democratize money; to allow people to spend money without concern to which country the money was tied to. However, their volatile value led to them becoming a form of investment.

Over the years, as cryptocurrencies have found more usefulness in regular trades and exchanges, their value has gone up. Their value has also artificially increased because of the impact of prospective investing. People are willing to buy Bitcoin at $15,000/bitcoin, because they think they can sell it to somebody else if the value goes up to $20,000/bitcoin. This would be similar to buying a stock, hoping its price goes up if the stock represented a company that has no discernible product but has plenty of hype. While cryptocurrencies have made many wealthy, they have also caused many to lose much of their life savings. Those wishing to not miss out on the potential gains would be wise to sidestep this minefield of investing. For the savvy goer who is a buy-and-hold index fund investor, cryptocurrencies don’t really hold a place in their portfolio. For those who want to play around with cryptocurrencies, only invest the amount of money you are happy to lose, just like gambling.

BONUS STRATEGIES

1. IPRCs (In-Plan Roth Conversion)

If you have traditional / pre-tax money in your 403b, it could be possible to convert that money into Roth / taxed money. This is a ‘taxable event’, which means you would be liable to pay taxes on the amount you convert. However, if you claim the FEIE and exclude all of your salary from being taxed, then you still have the standard deduction amount of money that you could ‘earn’, and still pay no tax. This means that you could trigger a taxable event by converting $10k (for example) of traditional money inside your 403b to be Roth money, and your tax bill for that amount could be $0. That money is then forever tax-free, as Roth money inside your 403b. Check with your 403b provider to see if this is an option on your plan. For example, Guidestone describes IPRCs here and specifically how they are useful for expats here.

2. In-Service Withdrawal of Post-Tax Contributions

This technique is more involved. It requires 2 steps:

- Making after-tax contributions to your 403b.

- Rollover (or withdraw) those contributions to a Roth IRA.

The benefit of this technique is that it allows you to move money from a 403b, which usually has higher fees, to a Roth IRA, which usually has lower fees. Over the long-term, savings in fees can add up to a substantial amount of money.

AN APPROACH TO CONSIDER

Inside your investing accounts (403b, IRA, and brokerage accounts), consider this approach.

1. Have a Roth IRA with a financial institution that charges the lowest fees possible (like Vanguard or Fidelity). Invest it in a total stock market index, like VTSAX for Vanguard. Don’t touch it until you are approaching retirement age. Contribute to the Roth IRA on years when you have taxable US-earned income. In years that you don’t have any US-earned income, you can contribute the same amount to your brokerage account instead.

2. Have a 403b with your employer-provided brokerage (like Guidestone). Make Roth 403b contributions each month from your paycheck and always shoot to ‘max out’ your account annually. Invest it in a total stock market index, like GEQZX for Guidestone. Don’t touch it until you are approaching retirement age.

3. (Advanced 403b approach) Make monthly traditional (pre-tax) contributions to your 403b in the years that you are in the US most of the year. Make monthly Roth contributions to your 403b in the years that you are outside the US most of the year. Lastly, perform In-Plan Roth Conversions (IPRCs) on the years that you are outside of the US to move your pre-tax 403b contributions and earnings to become post-tax inside your 403b. Only perform IPRCs for the amount of money that you can without actually incurring a tax bill (more in the next section).

4. When you are approaching retirement age (within 5-8 years), make changes to your asset allocation to be more conservative. You could move to an allocation of 80% stocks / 20% bonds at this time.

5. Annually, ask the question, “What fees am I paying in my retirement account and investments?” Go find all the fees and make sure you reduce fees wherever possible.

LEARN MORE

Don’t just take our word for it! Check out these other resources.

This page last updated April 2022